Skip to main content

- Intermarket analysis examines the correlations between the 4 major asset classes: stocks, bonds, commodities, and currencies.

- Traders can use these relationships to identify the stage of the business cycle and improve their forecasting abilities.

- There are clear relationships between stocks and bonds, bonds and commodities, and commodities and the U.S. Dollar.

- Knowing these relationships can help chartists determine the stage of the investing cycle.

FOUR MAJOR MARKET GROUPS

- Domestic & Foreign Bonds and/or Interest Rates

- 30 year treasuries

- 10 year treasuries

- 2 & 5 year treasuries

- Stocks & Equities

- Dow stocks

- S&P 500 stocks

- NASDAQ stocks, etc.

- Commodities & Futures

- CRB Index (barometer for commodities as a whole)

- Agricultures

- Financials

- Currencies

- U.S. Dollar

- Foreign currencies

INFLATIONARY ENVIRONMENT

- In a "normal" inflationary environment, stocks and bonds are positively correlated

- Below are key intermarket relationships in an inflationary environment:

- A POSITIVE relationship between bonds and stocks

- An INVERSE relationship between interest rates and stocks

- Bonds usually change direction ahead of stocks

- An INVERSE relationship between commodities and bonds

- A POSITIVE relationship between commodities and interest rates

- A POSITIVE relationship between stocks and commodities

- Commodities usually change direction after stocks

- An INVERSE relationship between the U.S. Dollar and commodities

- In an inflationary environment, stocks react positively to falling interest rates (rising bond prices). Low interest rates stimulate economic activity and boost corporate profits. As interest rates fall and the economy strengthens, demand for commodities increases and commodity prices rise. Keep in mind that an "inflationary environment" does not mean runaway inflation. It simply means that the inflationary forces are stronger than the deflationary forces.

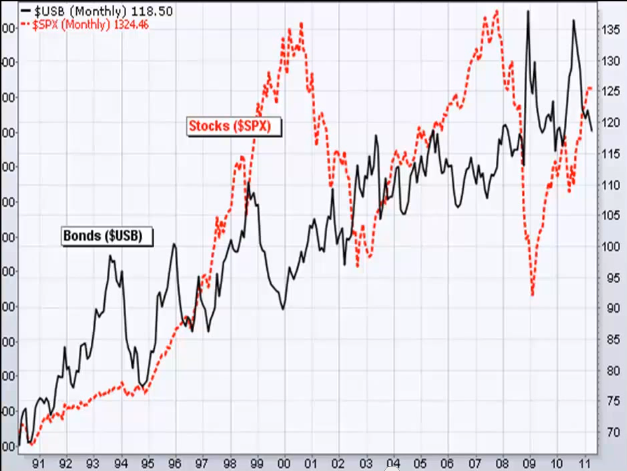

- The top chart is the 30 year treasury bond and the lower chart is the S&P cash index.

DEFLATIONARY ENVIRONMENT

- Deflation is negative for stocks and commodities, but positive for bonds. A rise in bond prices and fall in interest rates increases the deflationary threat and this puts downward pressure on stocks. Conversely, a decline in bond prices and rise in interest rates decreases the deflationary threat and this is positive for stocks.

- The list below summarizes the key intermarket relationships during a deflationary environment:

- An INVERSE relationship between bonds and stocks

- A POSITIVE relationship between interest rates and stocks

- An INVERSE relationship between commodities and bonds

- A POSITIVE relationship between commodities and interest rates

- A POSITIVE relationship between stocks and commodities

- An INVERSE relationship between the U.S. Dollar and commodities

US DOLLAR & FOREIGN CURRENCIES

- A weak U.S. Dollar is not bearish for stocks unless accompanied by a serious advance in commodity prices.

- A big advance in commodities would be bearish for bonds.

- A weak U.S. Dollar is also generally bearish for bonds.. a weak U.S. Dollar acts as an economic stimulus by making U.S. exports more competitive.

- A countries currency is a reflection of its economy and national balance sheet. Countries with strong economies and strong balance sheets have stronger currencies. Countries with weak economies and big debt burdens are subject to weaker currencies.

- A rising U.S. Dollar puts downward pressure on commodity prices because many commodities are priced in U.S. Dollars, such as oil.

- Bonds benefit from a decline in commodity prices because this reduces inflationary pressures.

Stocks can also benefit from a decline in commodity prices because this reduces the costs for raw materials.

- Below is an example of the inverse relationship between the U.S. Dollar and the commodity market as viewed by the CRB Index.

- At some point there will be a transfer/shift in the marketplace, when one makes higher highs and the other fails to make lower lows, that is an indication that there is a major shift underway and we have to be mindful of that. This is considered a major market divergence.

- Below you can see the relationship between the S&P 500 and Bond market (during an inflationary period, bonds and stocks will move together).

- When the U.S. Dollar surges, the CRB Index, or commodities, plunge.

- Below is a standard business cycle on a sign wave chart.

- It is a cycle that shifts in and out in the marketplace.

- Your best periods of trading be it stocks, futures, bonds, & forex will come when you are in sync with the

Macro Economic environment and your strong technical analysis.. you will have a double edged sword.

- The highest probable technical trends make ridiculous returns for the savvy trader.

- Learn to buy high risk asset class vehicles such as stocks, commodities, and foreign currencies when "risk is on" and the U.S. Dollar is weak.

- Learn to short high risk asset class vehicles when the U.S. Dollar is strong.

- These intermarket relationships generally work over longer periods of time, but they are subject to drawdowns or periods when the relationships do not work.

- Big events such as the Euro crisis or the U.S. Financial crisis can throw certain relationships out of whack for a few months.

- The tools shown here should be used in conjunction with other technical analysis techniques.

- It should be part of a basket of broad market study designed to assess the overall strength or weakness of the market.